Used BEVs selling faster than ICE vehicles in Europe in April with prices rising by 9.3%

- April 2022 could be the major sea change in the acceptance of electric used cars across Europe reports INDICATA boss

- Retail buyers are swapping to BEVS after seeing €50+ increases in filling a tank of fuel in an ICE vehicle

Used battery electric vehicles (BEVs) are now selling faster than petrol and diesel cars across Europe according to the latest INDICATA Market Watch used car insights report.

In April BEVs were the fastest-selling powertrain type in Europe at 6.8x whereas just 12 months ago they were the slowest at 3.7x.

Further evidence of the used market changing saw electric cars taking all three places in INDICATA’s fastest-selling used car table for the very first time in April with the Renault Zoe, Tesla Model Y and Kia Niro.

Market Days’ Supply for those respective used EVs was 27.7 days, 35.5 days and 44.7 days which compares with 74.8 days, 50.7 days and 60.8 days for April’s fastest-selling ICE cars, the VW Golf, Renault Clio, and VW Polo.

This is a dramatic change from the start of 2022 when used BEVs were consistently the slowest-selling fuel type and shows the speed of acceptance of electric power within the used market after a slow start in previous years. With supply now fully exceeding demand, dealer stock of used BEVs was 38% lower than in April compared with March.

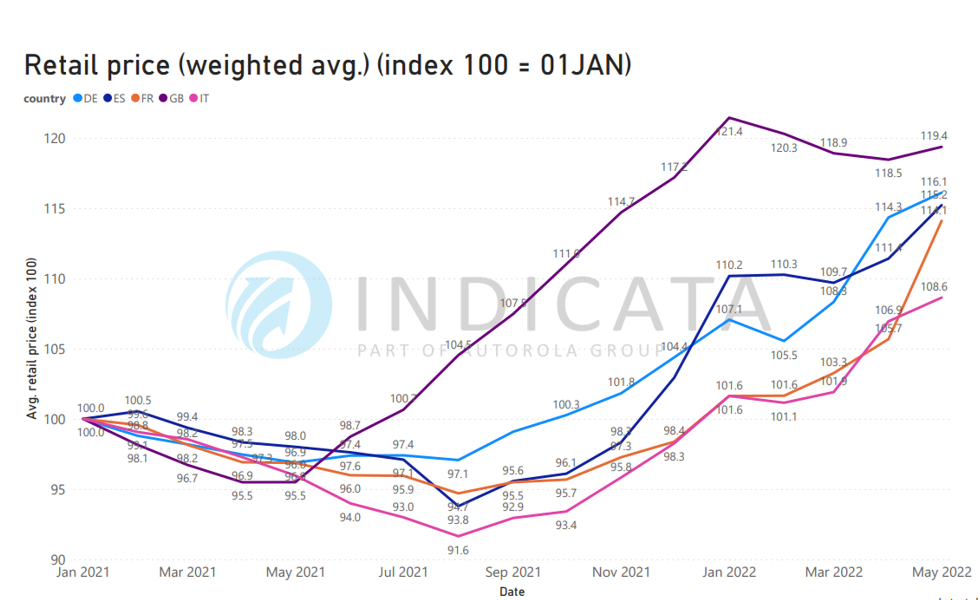

As supply tightens, BEV used prices are reversing the negative trend they have had for the last 4-5 years with a Europe-wide rise of 9.3 percentage points for used cars since the end of 2021.

Andy Shields, INDICATA’s global business unit director said: “April 2022 could be the major sea change in the acceptance of electric used cars across Europe. Last year we had seen excess BEV supply as OEMs over forced the market to reduce their CAFÉ liabilities.

“With retail buyers now seeing €50+ increases in filling a tank of fuel in an ICE vehicle they are swapping to BEVS. Long lead times on new BEVs and an ever-growing confidence in range and charging infrastructure means the used BEV market is now being sucked dry.”